China’s economic upswing boosts Asian economies. Turbulence in the banking sector and an expected recession in the US are weighing on the emerging markets. The interest rate hike cycle is coming to an end, no interest rate cuts in sight until later in the year

Number in focus

Apart from Turkey’s central bank, which has been pursuing an unorthodox monetary policy for some time, Vietnam’s central bank was the first of the major emerging markets to cut interest rates this month. However, it was also the only one. The vast majority of the central banks in the emerging markets are keeping interest rates at a very high level. The scope for reversing interest rate hikes remains limited for as long as the Federal Reserve continues to raise interest rates in order to combat inflation.

Chart in focus

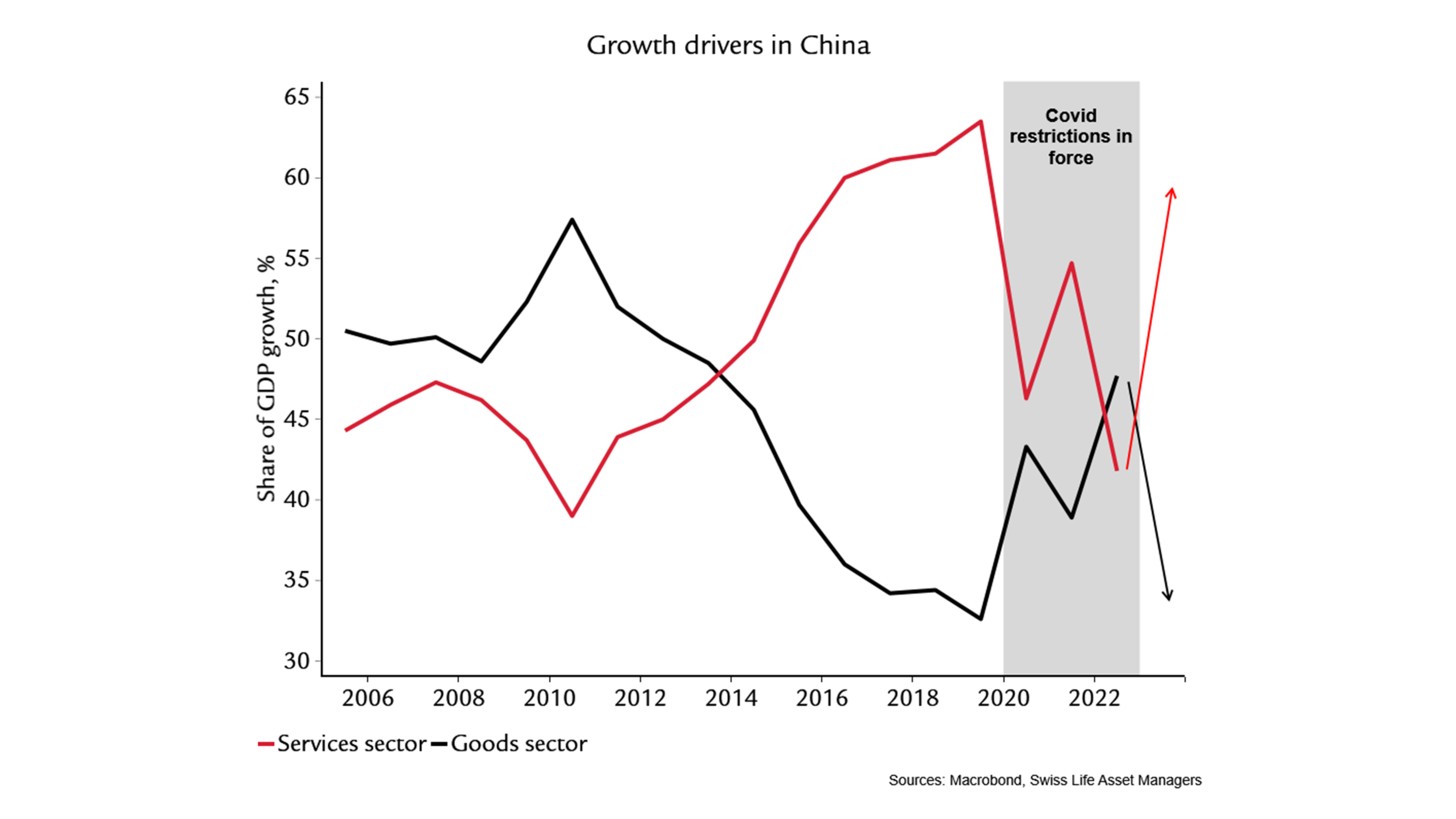

The Covid restrictions have caused significant damage to China’s economy and weighed particularly on the services sector, whose share of GDP has fallen sharply. Now that the restrictions have been lifted the economy is recovering, led by an upturn in the services sector, whose share of GDP growth is likely to return to pre-pandemic levels. Exporters of services to China are likely to benefit most from this upturn, i.e. mainly countries in Asia.