The sustainable management of risks and opportunities over different cycles are deeply rooted in our corporate DNA.

We have designed the Swiss Life Asset Managers investment strategy with a long-term, sustainable view that is in full synergy with our insurance liabilities. Apart from having integrated environmental, social and governance (ESG) considerations across all main business activities, we are undertaking various initiatives that go beyond standard integration. To us as an asset manager devoted to its fiduciary duty, responsible investment is not only a means to redirect capital flows towards sustainable development but also an important instrument to seize investment opportunities and reduce respective risks for our investors. We trust that sound sustainable investment solutions are validating their efficiency in managing risks and delivering more resilient returns, precisely because they support and finance companies acting for the well-being of society and shareholders alike.

ESG Concept

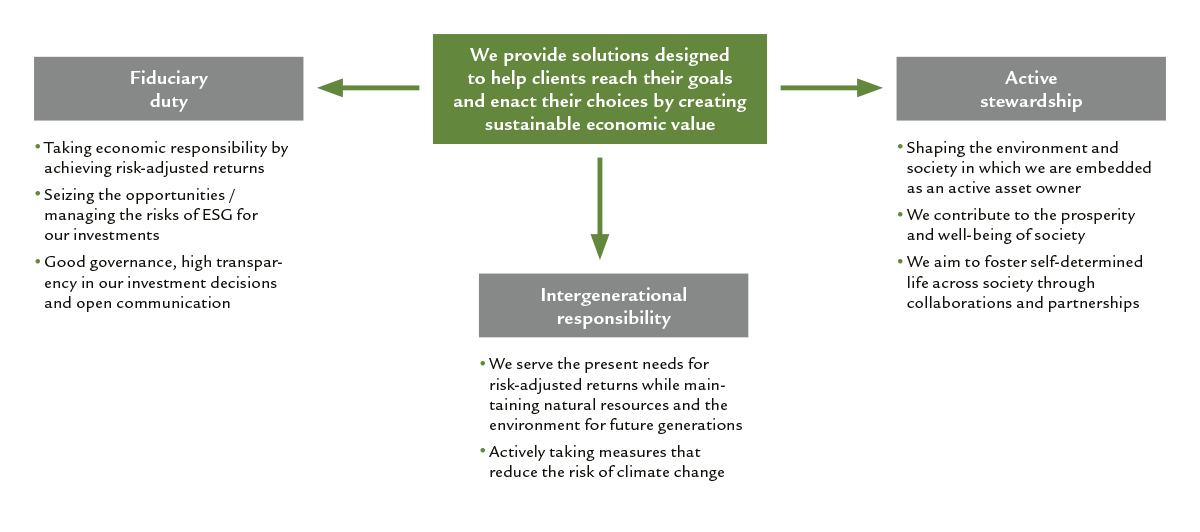

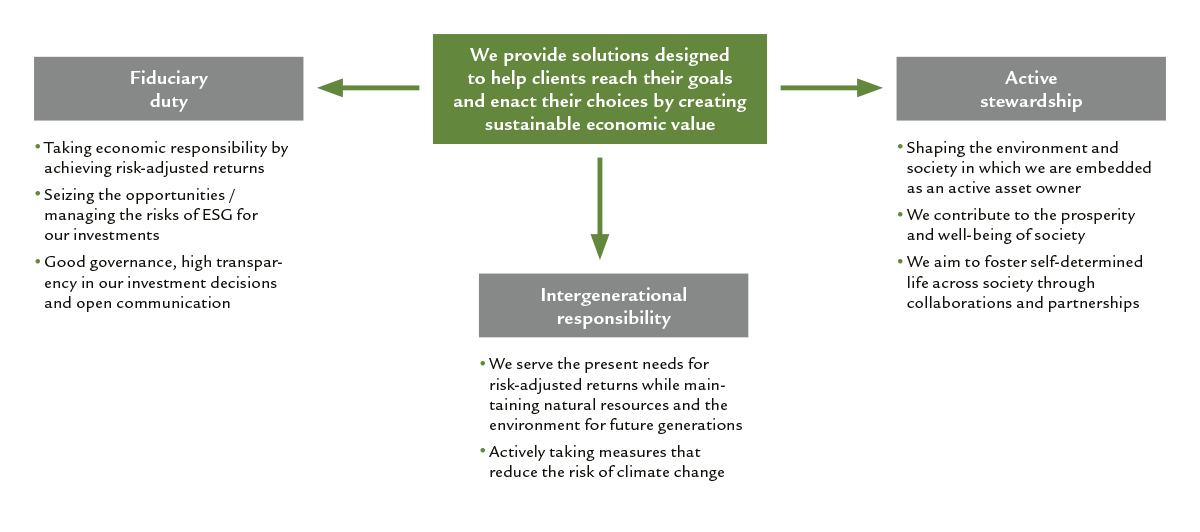

Our long-established tradition of sustainable investment is firmly rooted in our corporate DNA. Over recent years, we have enhanced and consolidated these values to create a comprehensive approach to responsible investment. This means an explicit ESG concept, built on three pillars of corporate responsibility: fiduciary duty, intergenerational responsibility and active stewardship.

Climate Change

Taking intergenerational responsibility as we work towards a more environmentally sustainable future is key to our approach. Climate change is one of the greatest threats that we are facing globally. As such, it presents significant risks to assets – but it can also give rise to new business opportunities. We believe this combination of risk and opportunity will shape investment portfolios and the nature of asset management in the long term. That is why we support the targets of the Paris Climate Agreement and have been committed to the framework of recommendations set out by the TCFD since 2018.

In 2021, the Swiss Life Group published its first TCFD-aligned Climate Report.

We set out the steps we are taking to minimise the impact of climate change and contribute to the global transition towards a low-carbon economy. We are also actively seeking ways to build the resilience of our clients’ investments in relation to climate change risks. That means identifying investment opportunities specifically related to lower carbon and energy efficiency.

Securities

We have launched a green investment programme in the area of securities. Our aim is to increase the share of investments in green bonds to CHF 2 billion by the end of 2023, in line with the ICMA Green Bond Principles. We have also formalised a thermal coal phase-out strategy for the bond portfolio, contributing to the transition towards a more sustainable and low-carbon economy and avoiding the risk of stranded assets. Over the past year, we reduced our exposure to companies that derive 10% or more of their revenues from thermal coal (either from mining or by selling it to external parties) to 0%.

Real Estate

As we sharpen our focus on sustainability, one of our top priorities is to increase energy efficiency across our extensive real estate portfolio. Swiss Life Asset Managers aims to acquire assets that already have strong energy efficiency credentials and on-site renewable energy production. We also actively improve less efficient new acquisitions or standing portfolio properties. A key component of our climate strategy is the monitoring of an extensive set of indicators. We keep a close eye on the energy consumption and carbon emissions of our property portfolio in line with the recommendations of the TCFD.

Infrastructure

We place a particular focus on low-carbon transition opportunities in our infrastructure activities. This approach is particularly evident with our recent acquisition of Fontavis, an infrastructure investment company specialising in clean energy. As the fight against climate change continues to bring fundamental changes to business models across every sector, as well as society as a whole, the transition towards a low-carbon economy creates major opportunities for infrastructure assets. For us, fields such as renewable energy, clean tech and logistics represent key areas of opportunity.

Integrating ESG into our day-to-day operations and product offering

At Swiss Life Asset Managers, conveying our company-wide responsible investment approach and comprehensive integration at product level is one of our key priorities. Following dedicated work and development on our policies and procedures, ESG considerations are now fully integrated for more than 90% of our assets under management. Additionally, a selection of portfolios follow dedicated ESG strategies that go beyond simple integration. Around 60% of our focus funds have been classified as Article 8 or 9 products, in the context of the recently introduced EU Sustainable Finance Disclosure Regulation (SFDR).

We believe that integrating ESG into investment decisions is more than simply a matter of adjusting standardised processes. It’s also a question of building and streamlining ESG expertise across our organisation as a whole. We therefore established the Swiss Life Asset Managers ESG Board, alongside our unique ambassador programme, delivering ESG training to employees who then roll out this knowledge within their individual business areas.

While the ESG board acts as the main governance body for ESG matters, the ambassador programme ensures company-wide ESG implementation into all of our day-to-day business processes.